Food consumption

Overview: food consumption in Italy

Food consumption: a comparison of Italy and the leading European countries

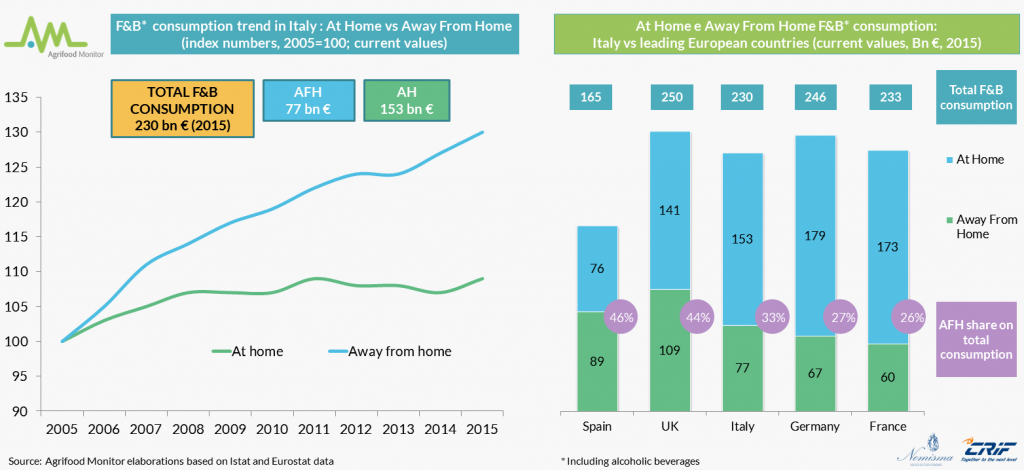

With a F&B consumption value of 230 billion Euros in 2015, Italy represents one of the main consumption markets in Europe. Compared to 2005, food consumption in Italy increased overall by 13% at current values, a growth that is mainly related to “away from home” consumption (+ 30%), which currently represents a third of total F&B consumption. This share is sharply lower than the ones recorded in countries such as UK and Spain (where the on-trade represents respectively 44% and 46% of total food consumption), but higher when compared to Germany and France.

F&B sales in Italy

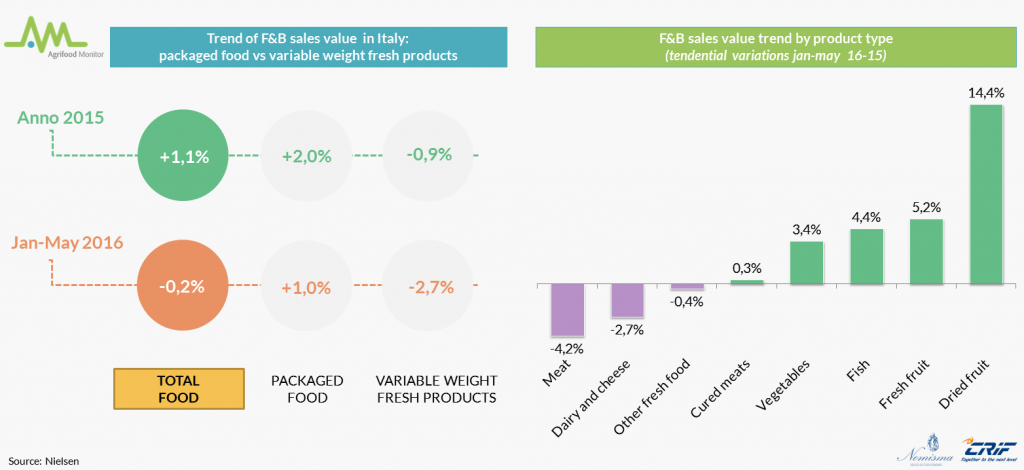

After a 1,1% growth in 2015, total food sales in the Italian large-scale retail remained stable during the first five months of 2016 compared to the same period of the previous year (-0.2%). This is the result of opposing trends among the different product categories. Focusing the attention on single product typologies, the sales of fruit (both fresh and dried), vegetable and fish increased I the period between January-May 2015 and the same period in 2016, whereas meat, dairy products and cheese experienced a declining trend.

Consumption habits

Selection criteria for food products in Italy

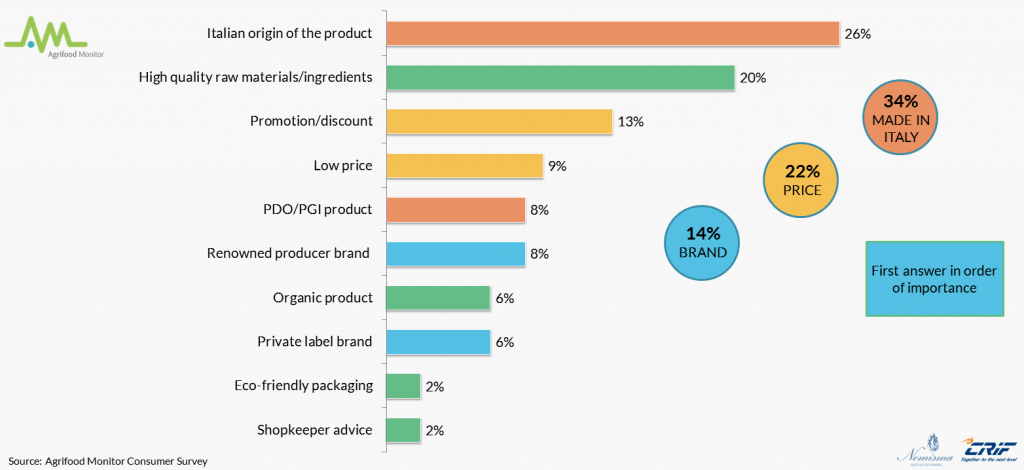

Italian consumers are more and more careful of what they eat: one out of three chooses food products depending on the Italian origin or on the presence of a PDO labelled product. Following the ranking, other important drivers are price (presence of promotions/cheap price) – main driver for 22% of consumers – and the quality of ingredients and raw materials (20%). Brand is the fourth driver of choice: manufacturer brand and private label (retailers’ own brand) represent the first selection criterion in F&B purchases according to 14% of consumers.

The role of promotions and private labels: 2000-2015 trend in large-scale retail

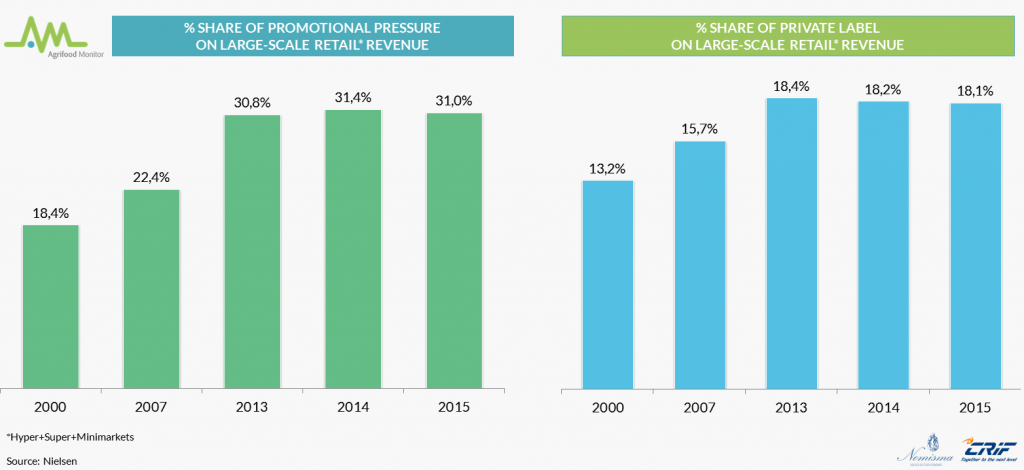

To protect their own purchasing power, Italians implemented some strategies that allowed them to buy quality and convenient products. The research for discounted products and the purchase of private label products are the expression of this evolution. Actually, between 2000 and 2015 the share of promotion on the total revenue of large-scale retail increased from 18,4% to 31,0%, whereas the effect of private label products passed from 13,2% to 18,1% in the same period. However, it is important to highlight the decrease – though marginal – in the promotional pressure recorded in 2015, after nearly a decade of rising trend. The same happens for private label products: between 2014 and 2015 the growth of their share on total large-scale retail revenue remained stationary.

New trends

New consumption trends: new and valuable products

The 2016 shopping cart of Italians is more and more healthy and natural: carefulness and sacrifice, which characterized the years of recession, are now giving room to a more careful and especially “functional” approach. Among the food products consumers would like to find on shelves, there is, first of all, light and low-fat food (whole-grain products, corn/rice cakes and plant based drink …), followed by ready-to-use products, such as ready meals and pre-packed cured meats (almost one out of three consumers looks for “time-saving” food products). Natural ingredients are a primary concern and organic products are still booming, recording a +21% growth in value, year ending May 2016 in large-scale retail.

Consumption segmentation map

Agrifood Monitor consumption segments

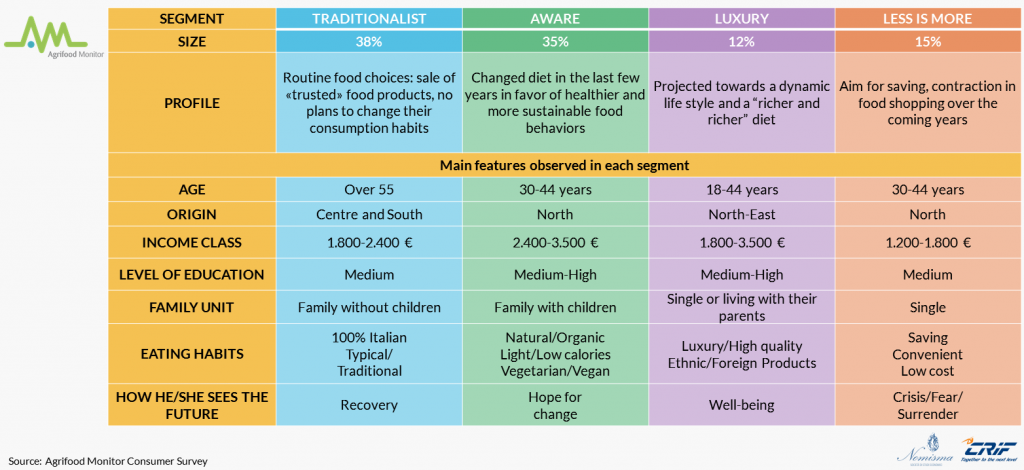

How is the Italian consumer base composed? The most relevant cluster is the one of “traditionalists” (38% of the Italian population), mainly composed by families of Centre/Southern Italy with low household income and medium education. Their food style is typical/traditional and tends not to change over time. “Aware” (35% of total) come after: this target is very careful about what to eat and prefers healthy and sustainable eating habits. This group is composed by families with children, has got a middle-upper income, and between 30-40 years old (median). The “luxury” segment (12%) includes young consumers projected towards a diet made of more expensive and valued products; they predict an increase in F&B purchase, especially “away-from-home”. On the contrary, 15% of the Italians aspire to save and even predict to reduce the expenditure on food: the “less is more” group is composed by singles with a low average income.

Food consumption: 2017 forecasts by target

For next year, the forecasts of food consumption see “aware” consumers as the most inclined towards food of plant origin (51% is willing to eat less meat), direct purchases (48% will buy more from farmers and farmers markets) and natural or home-made products. The highest share of those who predict to spend more for higher quality food products is registered among “luxury” consumers. The inclination for a careful and conscious consumption is common to all clusters: actually, about 40% of consumers shows a growing awareness to food waste.

Download the report

Request free full version of the report in PDF format, in a few moments you will receive an email with the link.

All fields marked with * are mandatory .